Mold. It’s a word that can make anyone irk, bringing to mind images of damp patches on walls and ceilings. But mold is more than a hideous sight—it’s a potential health risk and an expensive problem. If you’re renting, you might wonder if your renters insurance will help when mold appears.

Understanding renters insurance can be confusing. Policies are filled with terms, conditions, and exceptions that can be overwhelming. When it comes to mold, the coverage isn’t always clear-cut. Some situations might be covered, while others might leave you handling the issue alone.

Knowing what your renters insurance covers before you face a mold problem is essential. Does it cover mold removal? What about damage to your items? Are there specific conditions that must be met for a claim to be approved?

This blog will clarify the details of renters insurance and mold damage. We’ll explain when your policy might help and when it might not. So, let’s dive in—understanding your coverage can mean the difference between a minor hassle and a significant expense.

What Is Mold, and How Does It Affect Properties?

Mold is a fungus that thrives in moist environments and can grow on almost any organic substance as long as moisture and oxygen are present. In rental properties, mold is most commonly found in areas prone to dampness, such as bathrooms, kitchens, and basements. Poor ventilation and unresolved water leaks further contribute to mold growth.

The presence of mold on a property poses several risks. Health-wise, mold can cause various symptoms, including allergic reactions, respiratory problems, and, in severe cases, immune system suppression. From a property perspective, mold can lead to significant damage if left unchecked, eating away at walls, ceilings, and floors and compromising structural integrity.

Understanding Renters Insurance

Renters insurance is a form of property insurance that covers a tenant’s belongings, liabilities, and possibly living expenses in case of a loss. Renters need to understand exactly what their policy covers and the limits of that coverage.

Most renters insurance policies offer coverage for personal property on a named peril basis. This means the policy lists specific risks that lead to property damage or loss—such as fire, theft, or water damage from internal sources—that the insurance will cover.

However, all risks that can cause loss are not covered unless explicitly stated in the policy. Understanding these details is crucial for tenants to manage their expectations and claims effectively.

Understanding the specifics of your policy helps you navigate coverage limits effectively.

Now, let’s delve into how mold coverage is typically addressed in renters insurance, setting the stage for the general rules and exceptions that shape these policies.

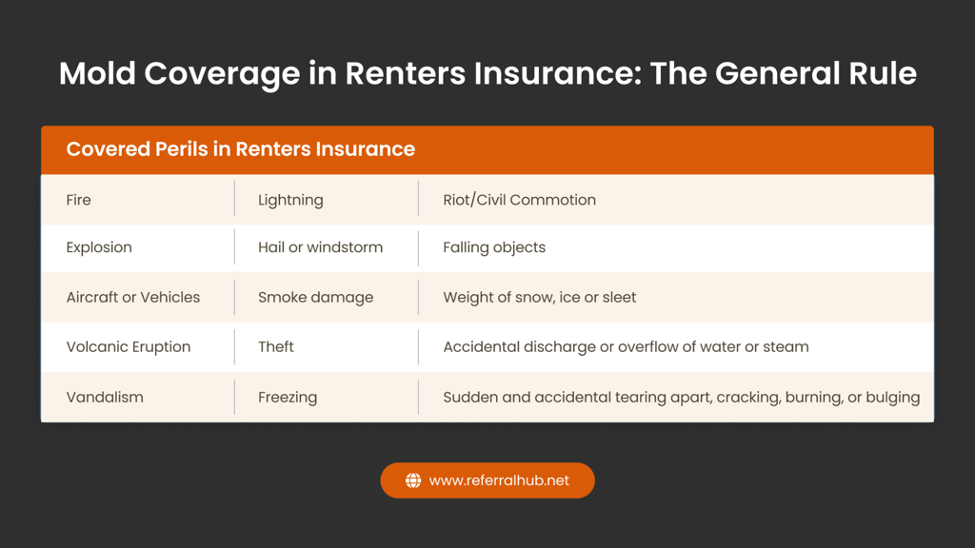

Mold Coverage in Renters Insurance: The General Rule

Mold coverage in renters insurance can be complex and varies significantly between different policies and insurers. Generally, the rule of thumb is that mold damage is only covered if it results from a “covered peril” listed in the policy.

Covered Perils and Mold

Most renters insurance policies include a list of covered perils such as fire, lightning, windstorm, hail, explosion, smoke, vandalism, theft, accidental discharge of water (like from a burst pipe), and more. If mold results indirectly from these incidents, your renter’s insurance will likely cover the mold remediation costs.

For example, mold remediation should be covered if a pipe bursts and saturates a wall, causing mold to develop due to the water damage.

However, if mold accumulates over time due to humidity or leaks that a tenant neglects, it won’t be covered. Insurance companies expect tenants to maintain the property and prevent such damage.

Limitations and Exclusions

It’s important to read the fine print of your insurance policy. Some insurers may cap the amount they will pay for mold removal, even if it results from a covered peril.

It’s important to read the fine print of your insurance policy. Some insurers may cap the amount they will pay for mold removal, even if it results from a covered peril. These caps can be as low as $1,000 to $10,000, which might not fully cover extensive mold remediation.

Moreover, specific policies exclude mold coverage or offer it as an additional rider that must be purchased separately.

Preventive Measures and Responsibilities

Renters insurance typically covers sudden and accidental incidents but not problems due to neglect or lack of maintenance. Therefore, renters must take preventive measures against mold growth, such as using dehumidifiers, ensuring proper ventilation, and promptly addressing leaks. Regular inspections and immediate reporting of issues to landlords can also help mitigate the risk of mold.

Understanding these general rules makes it easier for tenants to steer their coverage more effectively. It sets realistic expectations about what their renter’s insurance can provide in the event of mold damage. This knowledge empowers renters to take appropriate actions not only to potentially claim for mold damage potentially but also to prevent its occurrence in the first place.

When Does Renters Insurance Cover Mold Damage?

Renters insurance generally covers mold damage caused directly by a peril specifically covered in the policy. Here are some scenarios where renters insurance would likely cover mold:

Accidental Water Damage

If mold growth results from accidental and sudden water damage—such as from a burst pipe, a leaking appliance, or water used to extinguish a fire—these circumstances are typically covered. The critical factor here is the suddenness and unexpected nature of the incident.

Fire and Smoke

Mold from a fire or the water used in firefighting is usually covered. This includes mold that forms due to the high humidity conditions created during the extinguishing process.

Storm and Weather Damage

This situation could be covered if a storm damages the roof or windows and allows water to enter, leading to mold. The coverage is for the storm damage, and the mold remediation is a secondary stage.

Vandalism

If your rental is vandalized and results in water damage that leads to mold, your policy might provide coverage for this scenario.

In each case, it is essential to document the damage promptly and report it to your insurance provider to ensure coverage.

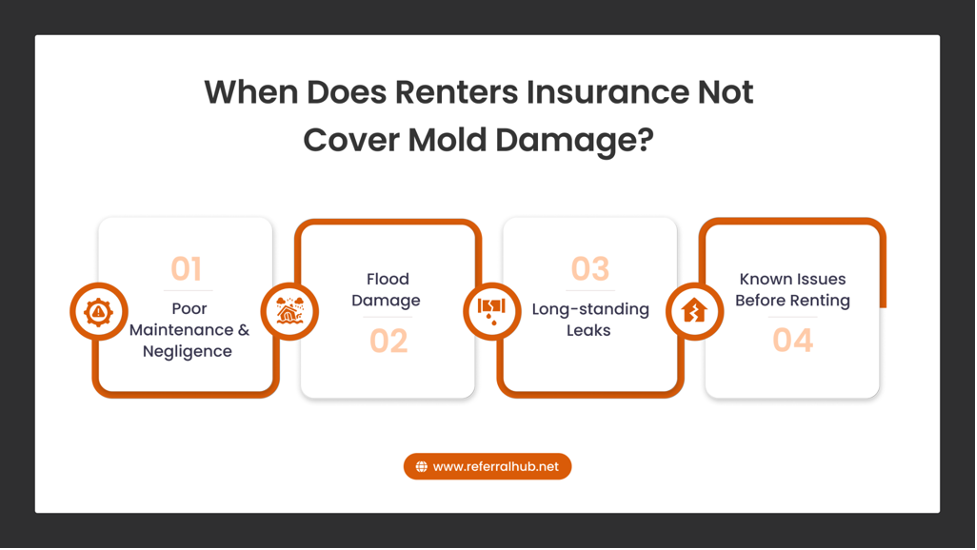

When Does Renters Insurance Not Cover Mold Damage?

While renters insurance covers many incidents, there are specific conditions where mold damage is typically not included:

A) Poor Maintenance and Negligence

- To Simplify: Mold that develops from ongoing issues such as slow leaks, persistent humidity, or inadequate ventilation is often excluded from coverage. Such problems usually indicate a lack of routine maintenance, which insurance policies require from the tenant.

- Implications: Tenants must regularly inspect their rental for any signs of water damage or excessive moisture and promptly address these issues. Failure to do so leads to potential health risks and financial losses due to uncovered mold damage.

B) Flood Damage

- To Simplify: Most standard renters insurance policies exclude flood damage, categorizing it as an extraordinary natural event. Consequently, any mold that develops due to flooding is also not covered.

- Implications: Renters in flood-prone areas should consider obtaining a separate flood insurance policy to cover water damage and any subsequent mold issues.

C) Long-standing Leaks

- To Simplify, Coverage is generally not provided for mold that results from leaks that have been present for an extended period. This is because such leaks are considered preventable with proper attention and maintenance.

- Implications: Renters must act swiftly when they detect leaks. Prolonged inaction may exacerbate the mold issue and lead to the denial of claims related to mold damage.

D) Known Issues Before Renting

- To Simplify: If the tenant was aware of existing mold or moisture problems before moving in and chose not to address or report these issues, claims for mold damage will typically be denied.

- Implications: Prospective tenants should conduct thorough inspections and inquire about moisture or mold issues before signing a lease. Reporting and documenting these issues before moving in can provide a basis for future claims and ensure they are not held responsible for pre-existing conditions.

Understanding these coverage limits helps renters assess their needs for additional insurance, like flood insurance or a mold rider, and encourages proactive maintenance to prevent mold growth. This proactive approach not only protects the property but also ensures the health and safety of the inhabitants.

Adopting a structured approach to prevention and handling mold is essential to effectively managing the risk of mold and its impact on your living environment.

Professional Solutions for Mold Prevention and Management in Rental Properties

The following table outlines the main actions professionals can take to safeguard your home against mold issues, emphasizing the value of expert intervention in maintaining a safe and healthy living environment.

| Action | Description |

| Professional Ventilation Assessment | Have experts assess and install proper ventilation systems in kitchens and

bathrooms to effectively control humidity. |

| Dehumidification Services | Engage professional services to install and maintain dehumidifiers during damp seasons to keep moisture levels under control. |

| Leak Detection and Repair | Utilize professional plumbers to detect and repair leaks promptly, preventing conditions conducive to mold growth. |

| Professional Cleaning | Regularly schedule professional cleaning services that use mold-killing solutions, especially in mold-prone areas like bathrooms and kitchens. |

| Moisture Assessment | Hire specialists to identify and document sources of moisture using advanced tools, ensuring thorough detection and documentation. |

| Professional Remediation | For extensive mold infestations, employ certified mold remediation companies to handle the cleanup and ensure that mold is completely eradicated. |

| Preventive Maintenance | Arrange for ongoing maintenance checks by professionals to ensure that the initial cause of the mold is resolved and to prevent its recurrence. |

Referral Hub streamlines your search for mold remediation experts by first understanding your specific needs, then vetting and dispatching certified professionals quickly. With one call, you receive up to three competitive estimates, allowing you to choose the best fit for your situation and budget. We ensure a hassle-free process and provide ongoing support to guarantee your satisfaction.

In conclusion, understanding whether renters insurance covers mold damage is crucial for effectively managing your rental experience. While policies typically cover mold resulting from covered perils, exclusions apply, primarily when the damage stems from neglect or external factors like flooding.

Renters must take proactive measures to prevent and manage mold. You can protect your health and belongings by maintaining proper ventilation, promptly addressing moisture issues, and understanding your insurance policy. Remember, a well-informed tenant is well-equipped to navigate the complexities of renters insurance and mold remediation.

Find Mold Remediation Pros Through Referral Hub!

Mold can cause health issues, provoke allergic reactions, and continue to damage materials in your home. To ensure mold is adequately addressed and does not spread throughout your living space, it’s crucial to have a licensed professional specializing in mold remediation. Referral Hub connects you with expert mold remediation professionals who can help restore your home safely and effectively. Plus, we accept all types of insurance, making the process smooth and accessible for everyone.

Take prompt action to protect your home and health from mold hazards. Connect with trusted mold remediation experts to ensure your property is thoroughly and safely restored.

Contact Referral Hub today!